Did you receive a notice about Pay Stub Requirements California? Did you receive a mail about a class action settlement to resolve Pay Stub Requirements California Lawsuit? This review will help you partake in the class action settlement after confirming the authenticity of the mail.

What Is Pay Stub Requirements California Class Action Lawsuit?

The law in California says that your pay stub must include nine pieces of information. If your employer forgets to include one or more of these items, you may be owed up to $4000 in damages.

Pay stub violations are particularly prevalent among employees who perform different types of jobs for which they are paid different hourly rates, like in a production facility. This does not mean, however, that other industries are immune from pay stub violations.

What Is This Class Action All About?

A number of companies have been sued in California for failing to provide their workers with accurate wage statements.

The lawsuits claim the paystubs were missing important information – such as the total number of hours worked and hourly pay rates – and that this violates state labor law. Some of these cases have already resulted in multi-million dollar settlements, and attorneys believe these lawsuits show no sign of slowing down. They want to talk to any employee in California who did not receive an accurate wage statement.

In California, it’s mandatory that your employer give you an accurate itemized wage statement every time you’re paid.

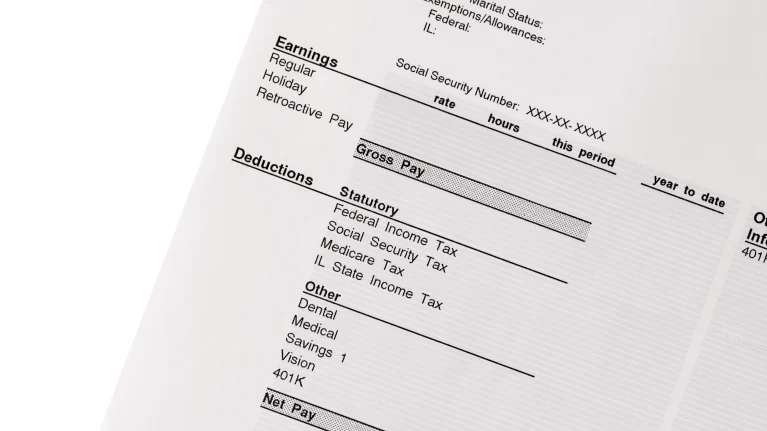

According to state law, your paystub must include the following information:

- Total gross wages

- Net wages earned

- Number of hours worked in the pay period

- The dates of the pay period

- Any deductions from your pay

- Your name and the last four digits of your Social Security number

- The name and address of your employer

- The number of piece-rate units earned, if applicable

- Your hourly rate(s) for the pay period, if applicable, and the number of hours worked at each rate

If your paycheck is missing any of these items, you may be able to file a class action lawsuit and seek up to $4000 in damages.

Federal law prohibits employers from firing or otherwise retaliating against workers who exercise their legal rights.

Who Is Eligible?

This settlement benefits all California workers who weren’t given accurate pay stubs.

How To Be Part of This Settlement

Class members must submit a valid and timely claim on the settlement website in order in this class action settlement.

What Is The Pay For This Settlement?

The pay for this settlement varies and the proof of purchase is not necessary.

Conclusion

As you submit your claim to the settlement website, just like Masterclass Privacy Violation class action settlement we have reviewed, you’re doing so under penalty of perjury. You are also harming other eligible Class Members by submitting a fraudulent claim.