A sneaky scam is going around, especially aimed at small business owners in the USA and Canada. The tricksters are sending fake government tax papers labeled “Form 4022”. These papers say you have to pay $117 as a “processing fee” or face penalties.

This article thoroughly looks into the Form 4022 scam. We’ll discuss how it operates, who’s involved, and most importantly, how you can keep yourself and your business safe from it.

What is the Form 4022 scam about?

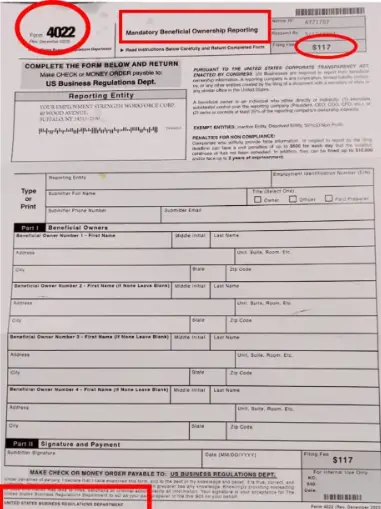

The Form 4022 scam happens when bad people send fake letters that look like they’re from the IRS to small businesses. They ask for $117 for a made-up thing called a “processing fee.” The letters say it’s for reporting beneficial ownership and warn about penalties if you don’t pay. But actually, there’s no such thing as Form 4022. They just want to trick you into giving them money and personal information.

How Form 4022 Scam Operates

The fraudsters probably buy lists of business addresses from illegal websites on the dark web. They might also get addresses from official business records or from previous hacking incidents. This helps them send letters directly to people they want to scam.

The letters say you have to report certain things by a certain date. If you don’t, they might charge you $500 every day or even put you in jail. People get scared because they worry about what could happen if they don’t do what the government says. This makes them more likely to do what the letters ask because they’re afraid of the consequences.

If someone pays the $117 fee, the scammers make money right away. They might also use any bank information given to them to do more fraud. After that, the scammers ask the person to fill out a form with lots of personal information. This helps them steal the person’s identity and do more financial crimes using their name.

What To Do If You Receive Form 4022 letter?

- Do not pay any money or provide information

- Discard the letter immediately

- Report the fraud to the IRS, FTC, and state attorney general

- Monitor accounts closely for signs of identity theft

- Consult a professional like a lawyer or CPA if needed

Conclusion

The Form 4022 scam might sound believable, but you can keep yourself and your community safe. Share this article to help warn others and prevent more small business owners from falling victim to this awful scam.

Also read:

Trustenely.com , Coinvaq.com

Mft-trade

Actionmarkets

Betail-capital